Education Savings Account Expansion – Passed

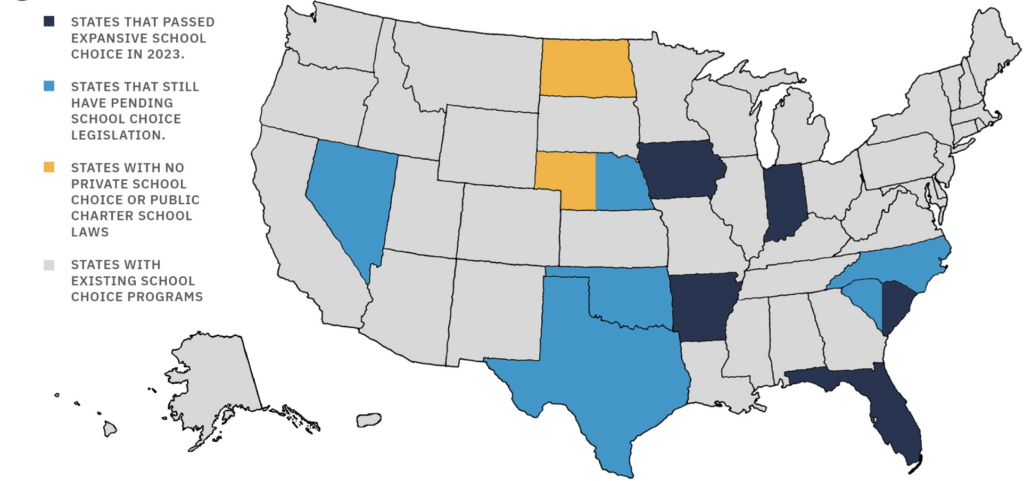

- – Indiana becomes the seventh state nationwide to pass universal or near-universal school choice, joining Iowa, Utah, Arkansas, and Florida, all of whom passed universal programs in 2023, as well as Arizona and West Virginia, who passed universal programs in 2022 and 2021, respectively.

- – Indiana’s voucher program is now available to any family below 400% of Free and Reduced Lunch (FRL) levels, or $222,000 for a family of four.

- – The various pathways previously required to participate in the program have been eliminated.

- – Income eligibility for Indiana’s tax credit scholarship and ESA programs was also increased to 400% of FRL.

- – Only an estimated 3.5% of Hoosier families with school-age children do not meet these income requirements.